Over the past 20 years many forward-thinking academics, consultants, executives, and NGO leaders have promoted a theory outlining how businesses can prosper while pursuing a greener and more socially responsible agenda. These people, whom I refer to collectively as “Sustainability Inc.,” believed that if companies committed to measuring and reporting publicly on their sustainability performance, four things would happen:

- Individual companies’ social, environmental, and governance (ESG) performance would improve (because what gets measured gets managed)

- A link tying companies with better sustainability records to better equity returns would emerge.

- Investors and consumers would reward companies with strong sustainability performance—and put pressure on those that lagged.

- Ways to measure social and environmental impact would become more rigorous, accurate, and widely accepted.

Over time, this virtuous cycle would result in a more sustainable form of capitalism.

A casual observer might think that this approach is working. In 2011 the authors of an HBR article titled “The Sustainable Economy ” expressed confidence that sustainability would soon “simply be how business is done.” To some extent, they’ve been proven right: The number of companies filing corporate social responsibility (CSR) reports that use the GRI (Global Reporting Initiative) standards—the most comprehensive ones available—has increased a hundredfold in the past two decades. Meanwhile, according to the Global Sustainable Investment Alliance, socially responsible investment has grown to more than $30 trillion—one-third of all professionally managed assets.

However, a closer look at the evidence suggests that the impact of the measurement and reporting movement has been oversold. During this same 20-year period of increased reporting and sustainable investing, carbon emissions have continued to rise, and environmental damage has accelerated. Social inequity, too, is increasing. For example, in the United States the gap between median CEO compensation and median worker pay has widened, even though public companies are now required to disclose that ratio.

It turns out that reporting is not a proxy for progress. Measurement is often nonstandard, incomplete, imprecise, and misleading. And headlines touting new milestones in disclosure and socially responsible investment are often just fanciful “greenwishing” (in the coinage of Duncan Austin, a former ESG investment manager). Worse yet, the focus on reporting may actually be an obstacle to progress—consuming bandwidth, exaggerating gains, and distracting from the very real need for changes in mindsets, regulation, and corporate behavior.

Not Measuring Up

I contributed to this failure as an enthusiastic member of Sustainability Inc. From 1992 to 2007 I worked at Timberland, a footwear and apparel company committed to marrying commerce with a philosophy of justice. Throughout my tenure (which concluded with seven years as the chief operating officer), Timberland’s approach to justice was built on three pillars: respect for human rights, environmental stewardship, and community service.

We took those commitments seriously. Timberland began offering employees 40 hours of paid community-service time in 1995; it was among the first publicly traded companies to use renewable energy to power its factories; and by printing “Green Index” scores on its shoeboxes, it pioneered package labeling that informed consumers about products’ environmental and social impact. In addition, Timberland issued a corporate social responsibility report as early as 2001, and in 2008 it started issuing such documents quarterly alongside its financial reports. We believed that measurement and transparency would increase competition within the industry to find sustainable solutions while engendering healthy pressure from investors and consumers.

Timberland’s attention to commerce and justice delivered strong financial results and built a powerful culture. We even won a presidential award for corporate citizenship. However, we learned that it’s extremely difficult to change the rules of competition in an industry—doing that requires much more than individual action. Moreover, reporting does not ensure environmental and social improvement—though people often conflate the two. And although it’s true that some researchers have found a relationship between ESG performance and financial returns, thus far they’ve merely established correlation. We don’t actually know if strong ESG performance causes better returns, or if both are a function of good management.

A decade after publishing “The Sustainable Economy,” the lead author, Yvon Chouinard—Patagonia’s founder and an authentic environmental pioneer—is no longer especially optimistic. He recently lamented, “It’s all growth, growth, growth—and that’s what’s destroying the planet.” Other prominent sustainability leaders have also soured on the promise of measurement and reporting. According to Auden Schendler, the senior vice president of sustainability for Aspen Skiing Company and author of the book Getting Green Done, “Measurement and reporting have become ends to themselves, instead of a means to improve environmental or social outcomes. It’s as if a person committed to a diet and fanatically started counting calories, but continued to eat the same number of Twinkies and cheeseburgers.”

The limitations of sustainability reporting became apparent at Timberland too. Despite the leadership team’s good intentions, as revenues grew during my tenure, so did the company’s environmental footprint. And sometime after my departure, and after the company was sold to VF in 2011, Timberland stopped labeling shoeboxes with Green Index scores because of the challenges in calculating them. Additionally, VF stopped reporting discretely on Timberland’s carbon emissions, though it does a very credible job of disclosing the conglomerate’s overall footprint.

The Problems with Reporting

There’s no doubt that attention to material ESG issues can deliver better social, environmental, and financial outcomes for individual companies. They are very likely rewarded with lower costs of capital (as a result of being better managers of risk), and their focus on sustainability can improve margins and enhance brand value. That said, corporate sustainability efforts have not, in the aggregate, made much difference for society or the planet. In addition, the reporting itself suffers from some very real problems.

Lack of mandates and auditing.

Most companies have complete discretion over what standard-setting body to follow and what information to include in their sustainability reports. In addition, although 90% of the world’s largest companies now produce CSR reports, a minority of them are validated by third parties. As a result, a lot of the input data is misleading and incomplete. By contrast, financial reporting follows agreed-upon standards, and compliance is ensured by a referee (in the United States, the Securities and Exchange Commission).

Specious targets.

According to a 2016 study that examined more than 40,000 CSR reports, less than 5% of reporting companies made any mention of the ecological limits constraining economic growth. Even fewer—less than 1%—stated that when developing their products, they integrated environmental goals that align with experts’ understanding of planetary boundaries. Instead, most companies set goals based on their capabilities or aspirations. Science-based targets, along with corporate emissions allocations in keeping with the same, have become more common since that study was done, but at this stage they remain aspirational.

Opaque supply chains.

Decisions made to chase low-cost labor have led to highly distributed supply chains where the producers of goods are often located nowhere near the end users. In the industry I know best, footwear and apparel, supply chains have disappeared from view. When I started working at Timberland, the overwhelming majority of our boots and shoes were produced in Timberland-owned factories, almost all located in the United States. Our factory workers were among our customers; social and environmental decisions had local impact. No more. Today at least 85% of the brand’s production is overseas, primarily in Asia. In addition, across the industry, supply chains have become multitiered and contractors have increasingly outsourced to subcontractors; that’s made traceability problematic. And audits have failed to stem social and environmental abuses.

Reporting is not a proxy for progress. Measurement is often nonstandard, incomplete, imprecise, and misleading.

Opacity plagues many other industries, too, including food, cars, and construction. Andy Ruben, who was the first chief sustainability officer at Walmart, notes that “even companies with Walmart’s influence find it challenging to really understand what is going on in an increasingly global and interconnected supply chain.”

Complexity.

Advances in technology (artificial intelligence, satellites, sensors, blockchain, and so forth) have given companies new tools for measuring and monitoring their environmental impact. Yet reporting on vital sustainability metrics still has gaping holes.

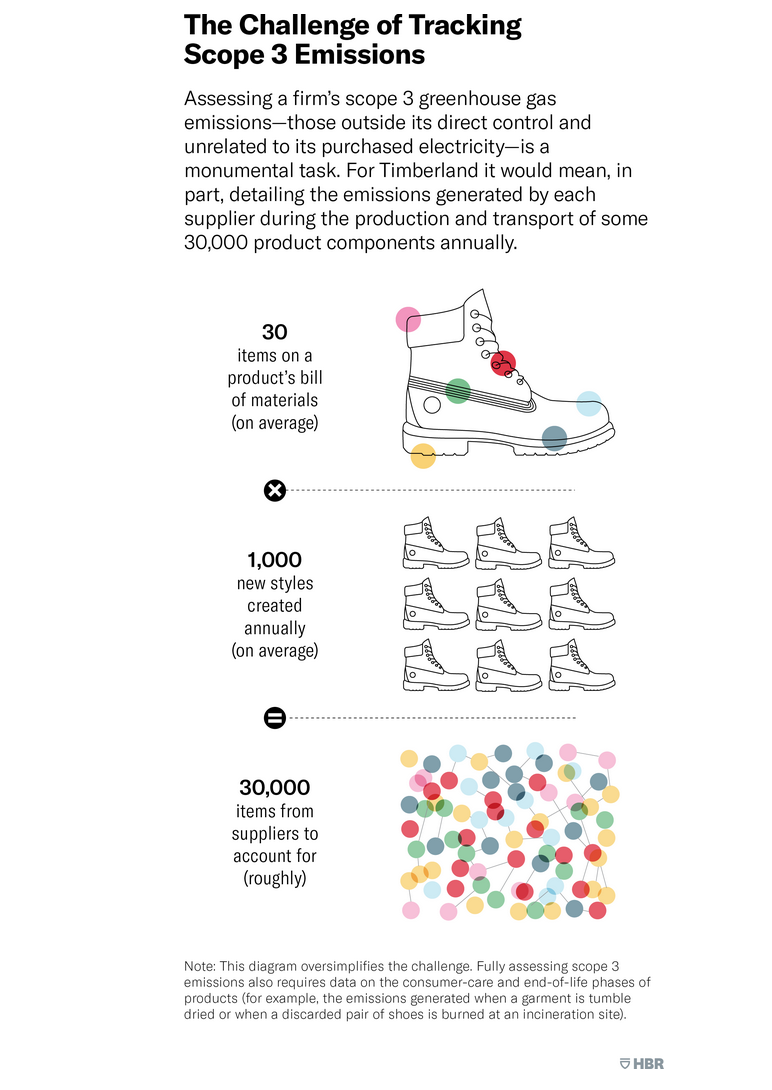

Consider the arcane yet essential world of carbon measurement. To get a complete picture of its carbon footprint, a company needs to measure three types of emissions: those produced by its own facilities and vehicles and thus under its direct control (classified as scope 1); those associated with its purchased electricity (scope 2); and all its other upstream and downstream emissions, including those generated by suppliers and distributors, by employees’ business travel, and by the usage of products sold (scope 3). According to CDP, the world’s leading aggregator of corporate carbon emissions data, fewer than half of the companies that disclose such data actually track and report on scope 3 emissions.

This is no minor matter. For many companies, scope 3 emissions represent the bulk of their greenhouse gas impact. Timberland, for example, estimated in 2009 that more than 95% of its carbon emissions fell into scope 3—and could not be tracked. Complexity, an absence of tools, and a lack of measurement by upstream suppliers and downstream users make it nearly impossible to access the data needed to complete a comprehensive emissions profile.

Confusing information.

Even for consumers who care about sustainability issues and are dogged in their pursuit of sustainability information, CSR reports are often bewildering. How, for example, is a consumer to interpret Patagonia’s statement that making one of its fleece jackets generates 20 pounds of CO2, or Levi’s disclosure that production and subsequent care (laundering) of a pair of 501 jeans will add 48.9 grams of phosphorous to freshwater or marine environments? Unlike with temperature or calories, consumers have no intuitive reference point that helps them understand many measures of environmental impact. Even metrics that seem easy to grasp may cause confusion. Consider the amount of water it takes to produce a one-liter bottle of Coke: The Coca-Cola Company’s own estimates have varied from less than two liters of water to 70 liters, depending on the methodology used.

Inattention to developing countries.

In its push for reporting, Sustainability Inc. has focused primarily on publicly traded U.S. and European companies. However, the greatest increases in consumption, emissions, and social impacts in the coming decades will occur in China, India, and Africa. Already, manufacturers in developing countries are turning more to their own domestic markets for growth. If there’s a hope of preserving key global resources, companies in those markets will need to become far more efficient managers of resources, with stronger governance structures.

The Problems with Sustainable Investing

Even if CSR reporting is seriously flawed, demand for investing sustainably is growing fast and leading to positive social and environmental impact. Right? If only that were the case.

While serving as Timberland’s COO from 2000 to 2007, I sat alongside the CEO and the chief financial officer 28 times as they delivered our quarterly results to Wall Street. Each time, the CEO devoted one-third of his scripted remarks to Timberland’s justice (or ESG) agenda. Never once did he receive a question about that part of the script. A recent conversation with the CFO of a publicly traded company with a market capitalization in excess of $30 billion leads me to believe that not much has changed on that score. According to the CFO, across his last 1,200 investor presentations he has gotten exactly three questions focused on ESG matters. Even if we assume that most investors care deeply about these issues, it is not clear that their pressure can deliver real social and environmental progress. Here’s a partial list of the reasons why:

Unhelpful definitions of “sustainable.”

According to the Global Sustainable Investment Alliance, nearly two out of every three dollars classified as socially responsible investment are in “negative screen” funds. Those are funds that qualify as sustainable because they exclude one or more categories of investments (say, tobacco or firearms). Such investing may appeal to individual investors, but it does next to nothing to track, promote, or reward ESG impact. Even more concerning is the fact that funds explicitly marketed as sustainable do not always live up to their billing. A 2020 study by Barclay’s looked at two decades of ESG investing and found no difference between the holdings of sustainable and traditional funds, and an investigation by the Wall Street Journal revealed that eight of the 10 biggest ESG funds in 2019 were invested in oil and gas companies.

Unreliable ratings.

John Elkington, a founding father of the sustainability movement, proposed the “triple bottom line” framework for reporting in 1994. That opened the floodgates: Dozens of other frameworks have been advanced since then, and standard setters and rating firms have proliferated. But the growth in the number of ESG raters has not improved reliability. As noted earlier, there are structural measurement and reporting problems because the data is voluntarily shared, largely unaudited, and incomplete. Researchers at MIT’s Sloan School of Management recently conducted a study of six top ESG ratings firms and concluded that “ratings from different providers disagree substantially….The correlations between the ratings are on average 0.54, and range from 0.38 to 0.71. This means that the information that decision-makers receive from ESG rating agencies is relatively noisy.” In addition, raters often seem unaware of what’s actually happening inside companies. For example, both Volkswagen and boohoo, the U.K. fast-fashion retailer, got high marks from ESG ratings firms before their respective scandals came to light (VW’s deception regarding diesel car emissions and boohoo’s exploitation of factory workers).

The profusion of standard setters, raters, and data has had the opposite of its intended effect. PwC reported in 2016 that while 100% of the corporations it surveyed had confidence in the information they were providing, fewer than one-third of investors shared their confidence. The philosopher Onora O’Neill has done research that helps explain why. She notes that “increasing transparency can produce a flood of unsorted information and misinformation that provides little but confusion unless it can be sorted and assessed. It may add to uncertainty rather than to trust.”

Lack of comparability.

It is nearly impossible to compare companies on the basis of ESG performance. Individual firms in the oil and gas industry, for instance, report on sustainability in varied ways: Out of 51 relevant GRI indicators, only four appear in more than three-quarters of the companies’ GRI reports, according to researchers at the University of Perugia. It is sometimes difficult even to compare the performance of a single company from year to year because of changes in methodology or decisions to use different metrics or standards to measure the same thing.

Challenges in assessing the success of socially responsible investing.

While measuring equity returns is relatively straightforward (even though attributing returns to specific factors is challenging), measuring ESG impact is far more complicated. To date, almost all the academic research has focused on the question of how ESG initiatives affect financial performance, with very little inquiry into how ESG investing affects workers or natural resources. Put differently, if one of the goals of socially responsible investing is to deliver positive social and environmental outcomes, how do we know if that investing is working? A recent study found little evidence that it is. According to the authors, the vast majority of ESG investment is allocated to mutual funds that either stay away from specific industries (mainly tobacco and weapons) or factor ESG data into their decisions about which stocks to buy (mostly to optimize financial performance). However, neither investment strategy was found to yield meaningful social or environmental outcomes.

Difficulty of scaling up truly effective impact investing.

A small but fast-growing subsection of socially responsible investment—impact investing—is specifically focused on addressing societal challenges. Some impact investors are explicit about their willingness to make financial trade-offs; others promise to address social and environmental issues without negatively affecting market returns. Here, too, there are issues. Even if you accept the premise that some of these investments will deliver social or environmental progress, not nearly enough capital is allocated to the impact investing category to address the huge challenges we face. That will probably be true as long as corporations are allowed to ignore externalities—the spillover effects that their operations have on society.

Where to Focus

Most of the sustainability effort at Timberland went into measuring and improving areas where the company had some control. For example, it put solar arrays on some of its buildings, installed LED light bulbs in its offices and retail stores, and limited workers’ hours in contractor factories. Other companies that have made sincere attempts to improve their social and environmental performance have generally behaved similarly: They’ve focused on what systems thinkers call parameters—dials that can be turned up and down to change performance without altering the structure of the larger system.

However, researchers have found that those parameters are rarely sources of real impact. The late Donella Meadows, the primary author of The Limits to Growth and a distinguished professor of system dynamics at Dartmouth, analyzed 12 types of intervention that would affect system performance and concluded that parameters are the least powerful. Probably 99% of efforts go to parameters, she wrote, “but there is not a lot of leverage in them.”

High-leverage interventions that would move the needle are largely outside the control of individual corporations. Such interventions wouldn’t be popular in the corporate world because they require changes in the rules governing companies’ behavior, a repricing of resources to address market failures, and a reorientation of how public assets are allocated and how power is distributed.

Unfortunately, Sustainability Inc.’s focus on measurement and reporting—and the underlying premise that market-based change would be sufficient—has likely helped to delay these much-needed structural transformations. So has misplaced faith in overhyped approaches such as “creating shared value” and “the circular economy”; these are touted as win-win, pain-free solutions, but supporters invoke case studies, not empirical research, as evidence. In her speech at COP25, in 2019, the climate-change activist Greta Thunberg astutely noted, “The biggest danger is not inaction. The real danger is when politicians and CEOs are making it look like real action is happening when in fact almost nothing is being done, apart from clever accounting and creative PR.”

This is not to say that investors and companies can’t make a difference. Corporate commitments to science-based goals are one promising path to improvement. It is good news that companies such as Apple and Microsoft are committing to net-zero trajectories, including for their scope 3 emissions, on a timeline that’s consistent with the planetary boundaries framework. Just recently BMW announced that its suppliers’ carbon footprints will be a key factor in procurement decisions going forward, and Climate TRACE, a coalition funded partly by Google, is developing a satellite-based tool to measure all emissions, including scope 3, in real time. These are welcome advances.

But if we are to bend the global emissions curve downward and address growing environmental and social challenges effectively, a more aggressive approach is needed. The following suggestions are places to begin.

Measure less, better.

The current plethora of authorities and frameworks for ESG measurement is unwieldy, confusing, and burdensome for companies. It’s encouraging that five of the leading standard setters and measurement bodies—including GRI and the Sustainability Accounting Standards Board—are collaborating to streamline and harmonize standards for reporting. The European Commission and the International Financial Reporting Standards Foundation are undertaking other efforts to improve reporting practices. My hope is that what emerges will include a commitment to a transparent application of rigorous science-based targets in line with nature’s limits. No matter what standard ultimately prevails, sustainability reports must be mandated and audited by an empowered referee.

“The real danger is when politicians and CEOs are making it look like real action is happening when in fact almost nothing is being done.”

Mobilize.

Vested interests and system inertia have been formidable obstacles to progress. Attempts to self-regulate have delivered incremental gains that have been subsumed by business as usual and the unyielding pressure to grow. However, with mounting evidence that climate change is harmful and accelerating, grassroots global movements for action—such as the Sunrise Movement and 350.org—are making what the civil rights hero John Lewis called “good trouble.”

Spend government funds on the right things.

According to the IMF, global subsidies for fossil fuels topped $5 trillion in 2017. In the United States, tens of billions of dollars have gone to subsidies for biofuels, including ethanol. This makes no sense. We are using taxpayer money to subsidize energy sources that accelerate future environmental damage. Imagine if governments instead invested those resources in R&D for carbon capture, incentives for retrofitting buildings, or infrastructure to spur faster growth in renewable energy.

Change the system.

Executives and investors operate in keeping with the rules and incentives of the system. If their behavior is to change, the rules that governments set and enforce also need to change. More specifically, as a partial list, corporations should be prevented from co-opting the regulatory apparatus; carbon emissions should be capped or taxed to account for their social costs; the agriculture industry should be incentivized to transition from spewing carbon to sequestering it; and lawmakers should ban the building of new thermal coal plants as a source of primary energy.

In addition, as Meadows pointed out when discussing leverage points for system intervention, our mindsets and assumptions about how the world works are potential sources of profound impact. A sustainable system will ultimately require a paradigm shift from the prevailing goal of wealth creation to one of well-being, and a shift in focus away from GDP and toward something akin to the OECD’s Better Life Index. Commitments to concepts such as regenerative agriculture, reuse, and collective value represent first steps in the right direction.

After two decades of trying, it should be clear that the market alone will not address worsening social and environmental challenges. The British economist Sir Paul Collier summed up the situation well when he said that capitalism “doesn’t work on autopilot. Periodically throughout its 250-year history, capitalism has derailed. And when that happens, it’s been up to public policy to get it back on the rails—public policy and the efforts of private citizens, of firms and families.”

Ultimately, corporations exist within a broader system. The obsession with shareholder primacy has served executives and investors well, but it has left younger generations with a staggering bill. This past-due invoice includes environmental degradation, biodiversity loss, income inequality, and climate change. Going forward, stability and prosperity require that executive leaders advocate for structural changes that enable them to focus beyond the next quarter’s numbers. After all, like the members of Sustainability Inc., they, too, want to pass on a better world than the one they inherited.

Read more on Harvard Business Review