On the Swedish coast of the Baltic Sea, in the city of Sundsvall – home to the country’s pulp and paper industry – a team of scientists, chemists, entrepreneurs and textile manufacturers are celebrating a milestone birthday, under a banner which features the slogan “#SolutionsAreSexy”.

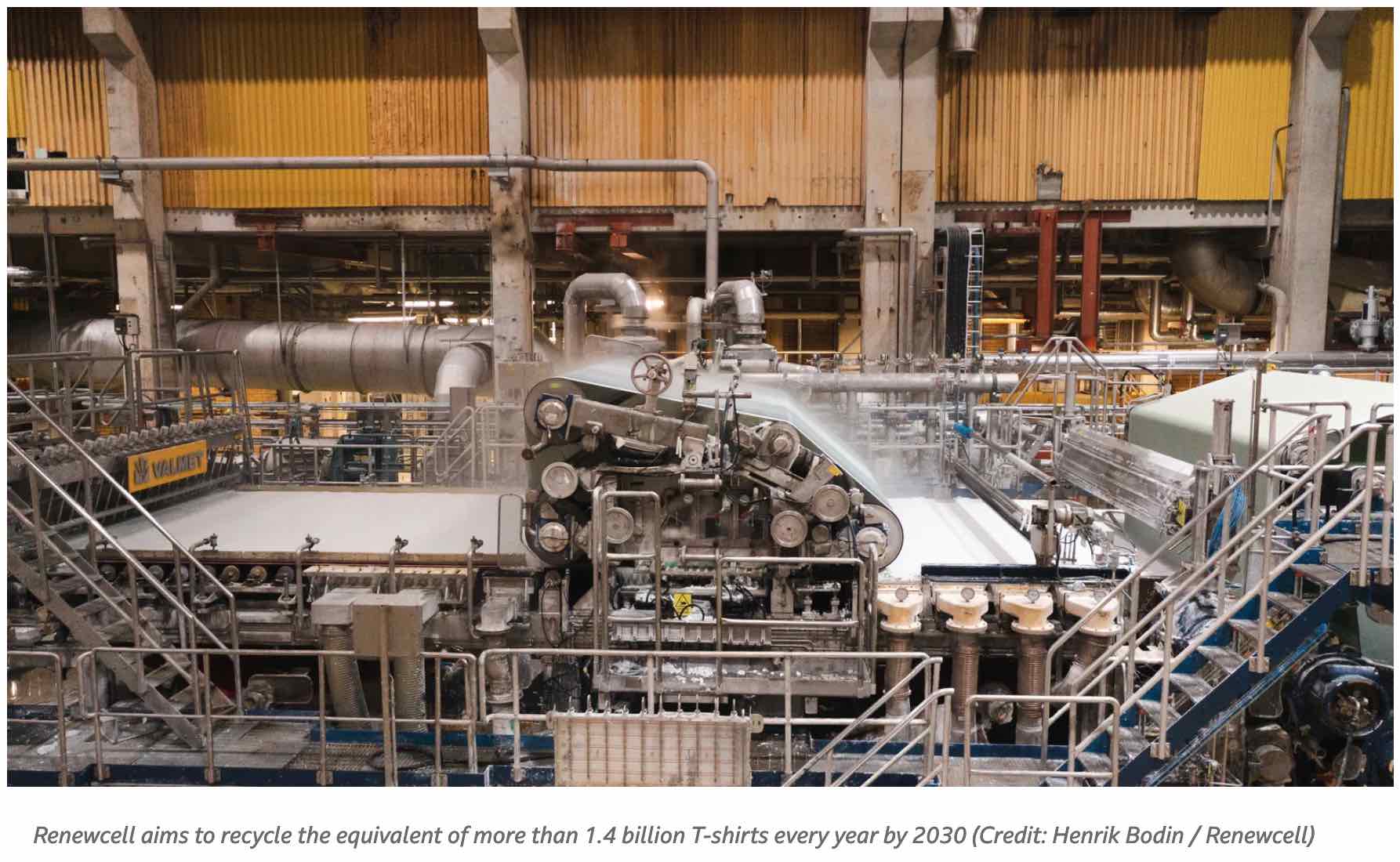

The Swedish pulp producer Renewcell has just opened the world’s first commercial-scale, textile-to-textile chemical recycling pulp mill, after spending 10 years developing the technology.

While mechanical textiles-to-textiles recycling, which involves the manual shredding of clothes and pulling them apart into their fibres, has existed for centuries, Renewcell is the first commercial mill to use chemical recycling, allowing it to increase quality and scale production. With ambitions to recycle the equivalent of more than 1.4 billion T-shirts every year by 2030, the new plant marks the beginning of a significant shift in the fashion industry’s ability to recycle used clothing at scale.

“The linear model of fashion consumption is not sustainable,” says Renewcell chief executive Patrik Lundström. “We can‘t deplete Earth‘s natural resources by pumping oil to make polyester, cut down trees to make viscose or grow cotton, and then use these fibres just once in a linear value chain ending in oceans, landfills or incinerators. We need to make fashion circular.” This means limiting fashion waste and pollution while also keeping garments in use and reuse for as long as possible by developing collection schemes or technologies to turn textiles into new raw materials.

Each year, more than 100 billion items of clothing are produced globally, according to some estimates, with 65% of these ending up in landfill within 12 months. Landfill sites release equal parts carbon dioxide and methane – the latter greenhouse gas being 28 times more potent than the former over a 100-year period. The fashion industry is estimated to be responsible for 8-10% of global carbon emissions, according to the UN.

Just 1% of recycled clothes are turned back into new garments. While charity shops, textiles banks and retailer “take-back” schemes help to keep those donated clothes in wearable condition in circulation, the capabilities of recycling clothes at end-of-life are currently limited. Many high street stores with take-back schemes, including Levi Strauss and H&M, operate a three-pronged system: resell (for example, to charity shops), re-use (convert into other products, such as cleaning cloths or mops) or recycle (into carpet underlay, insulation material or mattress filling – clothing is not listed as an option).

Much of the technical difficulty in recycling worn-out clothes back into new clothing comes down to their composition. The majority of clothes in our wardrobes are made from a blend of textiles, with polyester the most widely produced fibre, accounting for a 54% share of total global fibre production, according to the global non-profit Textile Exchange. Cotton is second, with a market share of approximately 22%. The reason for polyester‘s prevalence is the low cost of fossil-based synthetic fibres, making them a popular choice for fast fashion brands, which prioritise price above all else – polyester costs half as much per kg as cotton. While the plastics industry has been able to break down pure polyester (PET) for decades, the blended nature of textiles has made it challenging to recycle one fibre, without degrading the other. (Read more about why clothes are so hard to recycle.)

By using 100% textile waste – mainly old T-shirts and jeans – as its feedstock, the Renewcell mill makes a biodegradable cellulose pulp they call Circulose. The textiles are first shredded and have buttons, zips and colouring removed. They then undergo both mechanical and chemical processing that helps to gently separate the tightly tangled cotton fibres from each other. What remains is pure cellulose.

After drying, the pulp sheet feels like thick paper. This can then be dissolved by viscose manufacturers and spun into new viscose fabric. Renewcell says it powers its process using 100% renewable energy, generated using hydropower from the nearby Indalsälven river.

As the most common manmade cellulosic fibre (MMCF), viscose is popular because of its lightweight, silk-like quality. MMCFs have a market share of about 6% of the total fibre production. Dissolving pulp cellulose is used by the textiles industry to make around 7.2 million tonnes of cellulosic fabrics each year, according to Textile Exchange. But the majority comes from wood pulp, with more than 200 million trees logged every year, according to Canopy, a US non-profit whose mission is to protect forests from being cut down to make packaging and textiles, like viscose and rayon. Not only does Renewcell’s technology help keep forests intact, it also produces a higher pulp yield. “A tree is made up of different parts, including cellulose, but about 60% of it is non-cellulose content that you can’t do much with,” says Renewcell strategy director Harald Cavalli-Björkman. “Aside from a small loss, all of the waste cotton we use is turned into pulp.”

The mill has a contract with Chinese viscose manufacturer Tangshan Sanyou Chemical Industries for 40,000 tonnes per year, and is in talks with other large viscose manufacturers, such as Birla in India and Kelheim Fibres in Germany. Swedish fashion brand H&M, which produces three billion garments per year and is an early investor in Renewcell, has signed a five-year, 10,000 tonne deal with the pulp mill – the equivalent of 50 million T-shirts. Zara also partnered with Renewcell on a capsule collection in 2022.

“We want to build more mills,” says Cavalli-Björkman, adding that Renewcell hopes to be able to recycle 600 million T-shirts within a year – the equivalent of 120,000 tonnes of textile waste and a doubling of its current capacity. “But that is still very little compared to the global market for textile fibres. By 2030, we’re aiming for a capacity of 360,000 tonnes.”

But Renewcell’s technology has limitations: it can only recycle clothes that are made of cotton, with an allowance of up to just 5% non-cotton content. “Partly, it’s because it’s difficult to separate polyester, too much of which affects product quality, but also, we want to make sure we have a decent yield coming out the other end,” says Cavalli-Björkman. “With the exception of things that require exceptional durability like workwear or specific properties like waterproof clothing, the only reason for using polyester is because it’s cheap – yet with a huge cost to the environment. We’d like to turn back that tide, to get clean materials and fewer blends into circularity.”

Cavalli-Björkman says that fast fashion’s reliance on low-cost synthetic fibres has affected consumer attitudes towards the value of clothes. “Before we had industrialised textiles production, people took care of their clothes,” he says. “They repaired them because clothing was an investment. Today, clothing is so cheap that the perception is, you can always grow some more cotton, you can always pump some more oil – that’s far easier than putting the effort into creating a quality product from something that already exists and could stay in circulation.”

Natascha Radclyffe-Thomas, professor of marketing and sustainable business at the British School of Fashion, agrees that it‘s a question of value. “We often feel like we can recycle our way out of waste, and while recycling is a key part of the solution, it’s not the starting point,” she says, pointing to overproduction and consumption as root causes of the fashion industry’s waste problem. Inexpensive, low-quality clothes mean it is often cheaper for consumers to buy a new outfit, rather than getting an item repaired.

But other companies are focusing their efforts on synthetic and blended materials which are widely used by fast fashion brands.

Worn Again Technologies, based in Nottingham in the UK, raised £27.6m ($34.2m) in October to build a textile recycling demonstration plant in Winterthur, Switzerland, for hard-to-recycle fabric blends, such as clothes made from polyester and cotton mixes. Rather than operating its own commercial-scale mill, Worn Again (in which H&M has also invested) is developing a process to be licensed to large-scale plant operators around the world, due to be launched in 2024.

As its feedstock, Worn Again uses textiles made from pure polyester or poly-cotton blends, with up to 5% tolerance of other materials excluding metal, such as zips and hardware. There are two output streams. One is a PET pellet, which has the same chemical structure and make-up as virgin PET, to be made into recycled polyester. The other is similar to Renewcell’s: once the cotton is separated from the poly-cotton blend, the cellulose is purified and recaptured in the form of a pulp or cellulosic powder, to be made into viscose.

Worn Again’s technology is different to what is currently available because it uses chemical, rather than mechanical recycling, which splits the polymer chains and brings them back to virgin equivalent molecular weight. This allows for better quality and scaleable recycling of polyester and poly-cotton blends. Another key differentiator of the technology’s chemical recycling is that it can recycle textiles back into textiles.

Radclyffe-Thomas says this sort of approach may help to address the systemic issue of circularity in the fashion industry when it comes to synthetic fibres. Many brands, she says, often peddle claims of recycling and reusing textiles by championing their recycled polyester collections, but, in fact, these garments are not “circular” because they are made from recycled plastic bottles – not textiles.

“The vast majority of recycled polyester in fashion comes from a different supply chain altogether: the plastic bottles industry,” she says. “Originally, when brands started making garments from plastic bottles, it was seen as a very positive step. We see now that this isn’t a circular model.”

According to a report by the campaign group Changing Markets Foundation, “turning plastic bottles into clothes should be considered a one-way ticket to landfill, incineration or being dumped in nature”. Not only is the polyester being taken out of a closed-loop system where they would normally be recycled back into bottles, the report says, the clothes made from it also shed microplastics into the environment and cannot be recycled multiple times.

“When we first started, we thought we’d be recycling pure polyester, but it wasn’t long before we realised that there isn’t a lot of pure polyester in the global pool of used textiles,” says Cyndi Rhoades, founder of Worn Again Technologies. “A high percentage of clothing is made up of blends, so we knew that if we wanted to create a solution for textile recycling, it had to be able to deal with blends.”

According to Rhoades, the goal is to have 40 licensed plants by 2040, each operating at 50,000 tonnes of output per year, the equivalent of two million tonnes of polyester and cellulosic raw materials going back into supply chains for making new textiles like viscose and recycled polyester.

It’s a space with a growing number of innovators using different technologies to recycle blends, including US-based Evrnu and Circ, which recently raised $30m (£24.2m) in funding. They are part of a 30-strong group of technology-driven companies working with Canopy.

Canopy also works with fashion brands, including US-based Reformation, for which viscose represents almost 50% of all fabric volume. Earlier this year, the brand relaunched its Ref Recycling programme.

“We’re aiming to reduce the volume of viscose we use and transition to alternatives that use recycled, regenerative, and renewable fibre sources by 2025,” says Kathleen Talbot, Reformation’s chief sustainability officer and vice-president of operations. “We’re starting out with recycling shoes, activewear, sweaters, outerwear and denim because those are categories and materials we have textile recycling solutions for already.”

The brand works with SuperCircle, a US tech company that manages the logistics of the recycling process from waste to reusable material, to sort and aggregate used Reformation products by fibre type. It then sends them to recyclers to make fibre that can be used in future products.

To scale circular fashion models, proper infrastructure and services that facilitate recycling and take-back schemes need to be in place and accessible, says Talbot.

Nicole Rycroft, the founder of Canopy, recalls incredulous conversations from as recently as 2013 about the potential of textile-to-textile recycling. “Many conventional producers told us we were crazy, that next generation solutions were impossible at commercial scale,” she says. “Renewcell is testament to what’s possible. By 2030, we want at least half of manmade cellulosic textiles to come from circular feedstocks.”

But she says there need to be regulatory policies in place too. Rycroft references the European Commission’s proposals to tackle textile waste by making them more durable, reusable and recyclable. The EU Strategy for Sustainable and Circular Textiles will call for all textiles on the EU market to be “long-lived and recyclable, made as much as possible of recycled fibres” by 2030. In addition, the EU will require textile waste to be collected separately, like paper or glass, by 2025.

Kate Riley, fibre and materials strategy lead for synthetics at the non-profit Textile Exchange, says companies will need to develop business models which focus on repair, rental and subscription.

“This is key to working towards closing the loop and transitioning away from reliance on conventional fossil-fuel derived synthetics towards textile feedstocks,” she says.

Textile Exchange describes the increase of textile-to-textile recycling as the “holy grail” of circular fashion. With a cohort of companies ready to scale their proven technologies, that goal no longer seems so elusive.

Read more on BBC